Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Kurt Matis

Here at FTNI, we’ve been in a lot of conversations lately discussing how siloed the payments space has become. With technological advances in mobile and online payments over the last decade, companies have had to stretch their capabilities to keep up, offering customers multiple different ways to pay. This is great news for customers, but it’s been a struggle to manage multiple, disparate payment platforms and the manual processes created as a result. Integrating the various technologies used for accounts receivables (AR) is a bit of a monster, frankly.

So in the next few blog posts, we’re going to explore the issue in depth, from the problem space (which we’ll cover in this post) to what we see as the solution (straight through processing) and finally, to the benefits we think you’ll experience as a result of moving to a true straight through processing model.

To provide some context, let’s start by discussing the three main payment types, and the operational and security issues with each.

CREDIT CARDS: Software and CRM vendors who cater to the payments industry typically focus on enabling their clients/users to accept credit card (CC) payments. Many of these providers haven’t invested in a true SaaS or off-premise solution, which increases security and compliance requirements on the business—adding a layer of cost and complexity to the AR operation, when the goal was to simplify the process. The good news is that these companies are moving to adopt SaaS-based solutions (via PCI compliant payment providers), so the PCI-compliant issues are beginning to go away—with credit card processing, anyway.

ACH: As a lower-cost alternative to CC, many business run a single or recurring ACH payments each month on the customer’s behalf. This is especially true in business-to-business (B2B) transactions where the invoice amounts can be much greater, resulting in higher CC fees. In industries like insurance, distribution and non-profit, where margins are low, adding higher CC fees is an unfriendly proposition. Early systems set fixed dates each month to process fixed amounts, but newer systems allow more flexibility for dates and amounts. These systems still need to store bank account information, and while no strict controls like PCI regulations govern the storage of this data, holding client bank data inherently increases risk for the business.

CHECKS: Everyone may be saying that the check is dead, but that’s not necessarily true—especially in the B2B space, and verticals that rely on remittance documents or “coupons” to be returned with each check to ensure proper allocation of the remitted funds. These companies may be trying to move their customers to a more automated payment channel, but change can be slow. In addition, when customers send in checks without accompanying remittance advice, it creates more manual work for AR, increasing costs and reducing efficiencies. Early bank and third-party software providers introduced remote deposit capture (RDC) to allow clients to scan and remit payments to the bank, but most of these solutions did not have software integrations that automatically uploaded the check (and remittance) data into their accounting or CRM solution. Therefore, you still had the issue with manual posting of the remittance data.

Each payment type comes with some basic operational and security issues. In tackling that, many times vendors will use multiple software applications to process these payments, instead of moving to one easily managed integrated receivables platform.

That leads to operational costs for training and support, not to mention inefficiencies with separate file integrations, reporting and reconciliation points. By trying to help clients with payments, our industry has, in effect, siloed each payment type—thereby creating more operational and technical complexity and cost, and defeating the original objective.

Some vendors are OK with this. They may not have single solutions to cover all payments, or they may be making enough money off their services (i.e. CC processing, core banking fees, etc.) that they don’t see a profit in solving these problems. In many cases, they refer their customers to a partner or third party, which just creates more data silos.

The problem is only intensifying as web payments and mobile payments become increasingly popular with B2B and B2C companies. Companies like Google and Apple are trying to compete in the payments space, but they’re only focused on CC payments, which leave a lot of other transactions on the table—like checks, which the 2013 AFP Electronic Payments Survey says we’ll be handling for at least the next decade.

A few numbers to consider:

In terms of B2B disbursements among major suppliers, 92% still use checks when paying at least some of their major suppliers.

In terms of collecting payment, 93% of businesses receive checks from their major business partners

42% of major business customers still make payments by check

The typical organization receives 50% of its B2B payments by check

70% of organizations are having a hard time converting to electronic payments

Only 11% of organizations today use mobile technology to initiate payments—and only 32 percent plan to do so over the next five years

Checks continue to be the most widely used method of payment to major suppliers. The average company makes an estimated 43 percent of its payments to major suppliers by check.

It’s a big problem, and our industry is not the one footing the bill—our customers are. They’re paying more than they need to for overly complex “solutions” that don’t actually solve their problems. In the next post, we’ll discuss market trends and what we see as the real solution: true straight through processing.

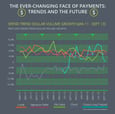

The Ever-Changing Face of Payments Infographic

The Ever-Changing Face of Payments Infographic

Checks may not be the next new thing—in fact, check use is on the decline—but believe it or not,...

Read More

Remote deposit capture (RDC) of checks has many benefits—not least, reducing the manual labor...

Read More

Part 2 of the 3-part True Straight Through Blog Series To sum up the payments problem: Clients are...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864