It’s nearing Christmas Eve, and while many good little boys and girls will have to wait to open their presents just a bit longer, we’re giving you a head start. Below, you’ll find six more gifts for you, wrapped and ready to go in our second and final installment of our holiday-themed “12 Gifts of True Integrated Receivables,” blog series.

In Part Two, you won’t see ten lords a leaping, but you will find yourself dancing like the eight ladies once you unwrap the final six gifts of True Integrated Receivables (IR).

Let’s recap the first six gifts of True IR:

- Consolidation of AR Processes and Technology

- Complete Oversight and Control of All Your AR Activity

- Straight-Through Processing (STP)

- Increased Efficiencies

- Proactive Security and Compliance

- Extreme AR Flexibility, Modularity, and More

Without further ado, we hope you enjoy the final six gifts of true IR...

The Seventh Gift of True IR: Robust Administration Capabilities

There’s no controlling the chaos that can ensue at some holiday parties, and there's definitely no containing the excitment come Christmas morning once the kids discover presents under the tree. The same shouldn’t be true for controlling the technologies that support your accounts receivables (AR) operations.

A true IR solution should have a central control module that allows internal administrators the ability to control user access credentials, workflows and much more. If you can’t control all aspects from a single interface...it isn't truly integrated.

Look for solutions with a dedicated administration module that lets you do the set-up and implementation of new customers and their users (if reselling the platform...e.g. Banks, ISOs and ISVs), as well as your own internal users (for example, giving out user credentials, allowing password resets, defining user-level access, etc.).

If you’re a bank, ISO or ISV looking to add true IR solutions to your portfolio, your chosen solution’s administration capabilities should be something you can extend to your customers, too. You should be able to give your customers admin rights, and user settings should be configurable on a user-by-user basis. By offering your customers self-management, you can reduce the number of high-volume, low-value calls to your service representatives and give your customers the power to solve problems in an easy and efficient manner.

The Eighth Gift of True IR: Dynamic Risk & Fraud Monitoring

Security, whether it be at your home or at your business, is essential to keep a clear mind. Santa coming down your chimney may not be the safest, but at least we know he is coming to give, not to take.

75% of organizations experienced check fraud in 2016, which is an increase from 71% in 2015. Although we’d all like to believe that customers will always act truthfully, the unfortunate truth is that this isn’t always the case. Your business must be equipped with the right tools to identify and handle potentially fraudulent payments in the most efficient and effective ways possible.

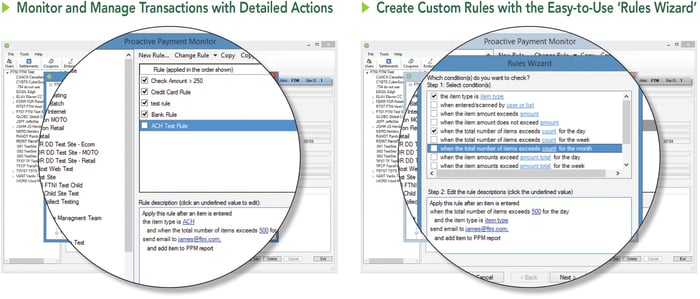

With True IR, you can rest assured that you’ll have the tools in place to alert you of potentially fraudulent payments within your receivables processes. With dynamic payment monitoring capabilities, top platforms will provide you with configurable business rules to proactively monitor all receivables activity and transactions from a single interface—significantly streamlining the identification and actioning of potentially fraudulent transactions before they ever reach the bank or merchant processor.

The Ninth Gift of True IR: Flexible APIs & SDKs

We can’t put a bow on every gift that True IR brings to your business, so let us be straight to the point with you on this gift. True IR solutions will allow your IT and development resources to integrate secure and compliant (PCI, SSAE 16, HIPAA and more) payment acceptance capabilities directly within your existing interfaces and mobile applications through the use of flexible APIs and SDKs. And by integrate, we mean complete integration.

Your business is in control of the look and feel of the web page or mobile app, all while delivering a variety of payment options (ACH or credit card via online payment options; check (via mobile RDC), ACH or credit card via mobile app) to your customers. What’s more, all of the remittance information can be consolidated into a single posting file, or applied in real-time into your back office accounting, CRM or ERP systems to provide straight-through processing and create significant efficiencies within your AR operations. Manual cash application tasks of Christmas past will be just that; in the past.

Your customers expect a seamless experience when they interact and transact with your business. The ability to provide them with convenient payment options across each touch point (i.e. online, mobile, in-person, over-the-phone, etc.) will only strengthen the customer experience by allowing your customers to pay how they want, when they want, via the channel they most prefer.

The Tenth Gift of True IR: Plug-n-Play Compatibility

Sometimes Christmas isn’t all bells and jingles. Sometimes it’s about fitting in with that family member or work colleague you may or may not have the kindest feelings for. However, you’re mature. You’ve been in this situation before, and you know that you can adapt to your surroundings. Maybe. Your handling of this situation may teeter slightly on what’s under that Christmas tree. But you can do it this holiday season, we believe in you. Adapt, adapt, adapt.

Speaking of the importance of adaptation, true IR solutions adapt the way you wish you could come holiday season, allowing your company the ability to tailor your internal AR processes and workflows as time goes and your business grows. Add a new line of business? Open additional office locations? Bring on an additional banking relationship? Change merchant processor relationships? Switching to a new back-office system? None of these situations should throw a wrench in your AR operations with the help of true IR solutions. Today's leading platforms are specifically designed to be easily tailored to your existing business processes and compatible with your existing banking, merchant processor and back-office relationships.

Since truly integrated platforms are agnostic in nature, your AR operations will be ready-made to handle the inevitable adaptation that time and growth will bring your way.

The Eleventh Gift of True IR: Bringing Banks and Fintechs Closer

As true IR solutions continue to grow in adoption, corporate banking customers are demanding more out of their banks' treasury and cash management offerings. Banks are quickly realizing they cannot keep up with the pace and innovation fintechs can provide, particularly when it comes to being able to deliver consolidated receivables processing solutions from a single platform.

When it comes down to it, banks are not technology providers, the same way technology providers are not banks. Each possesses highly valuable services and core competencies that corporate customers need. Luckily, as recent partnerships and investments show, banks and fintechs are increasingly finding ways to coexist. However, as our CEO recently pointed out, many of these partnerships and investments still fall short of delivering true IR solutions.

While receivables processing products are not new to banks’ cash management portfolios, historically the products offered have been disparate solutions. Each intended to address a need surrounding a specific payment method or channel. And many times each solution is ultimately delivered from a separate third-party partner of the bank. So while the bank may be able to deliver the capabilities to meet the customer’s needs, the customer is left to manage multiple solutions, from multiple interfaces and shoulder the ongoing training and associated costs of maintaining multiple solutions.

True IR can help banks by enabling them to offer holistic receivables processing solutions to their commercial clients, and in turn, creating a stronger relationship between not only banks and fintechs, but also banks and their commercial clients. Fintechs don't have all the answers, either, that’s why it is essential for banks and fintechs to work together now, and in the future.

The Global Fintech Report 2017’, published by the consulting firm PwC, forsees a new era in which financial institutions and fintech firms cooperate more closely, in order to overcome their respective weaknesses. We think they’re onto something and that 2018 will be the year that banks come to realize that partnering with true IR technology providers is a win-win-win scenario for banks, fintechs and corporate customers.

The Twelfth Gift of True IR: Future-Ready AR

Checks aren’t going away anytime soon, regardless of what some may like to claim. Especially in the realm of of B2B payments, the paper check has remained so ingrained in the remittance processes of businesses because of the critical information that can be delivered along with it. In fact, according to the 2016 AFP Electronic Payments Survey, B2B payments made by check increased in 2016 for the first time since 2013.

The check will continue to be a vital part of the B2B receivables mix for the foreseeable future, and AR departments will need to make sure that they are equipped to accept, process and post payments made by check (as well as ACH, CC and more) in the most efficient ways possible.

However, technology moves at the speed of customer demand, and customers want to be able to pay when, where, and how they want. Even B2B customers are starting to prefer electronic payment methods as their own AP departments seek new technologies and the efficiencies they create.

Today’s leading IR solutions are built to keep pace with payment technology advancement for the foreseeable future. By bringing True IR into your business, your company will be prepared for the inevitable evolution of your customers’ payment preferences. Whether it be ACH or credit card payments overtaking your check deposits, True IR will make sure your receivables run smoothly no matter what payment method or payment channel dominates your receivables mix now and for years to come.

In the same way that the great Andy Williams told us that, “Everybody knows, a turkey and some mistletoe will help to make the season bright,” we hope this holiday-themed take on truly integrated receivables solutions has helped shine some new light (and a little bit of fun) on the topic.

On behalf of all of us here at FTNI, we wish you the Merriest Christmas and Happiest New Year!

Originally published December 23, 2017.