Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Operating a geographically distributed model, Benchmark Senior Living faced remittance processing challenges typical to the industry. Benchmark operates a network of locally owned but centrally supported senior living facilities throughout New England.

Benchmark set out in search of a Remote Deposit Capture (RDC) solution that would help them consolidate the check acceptance and payment posting process, while respecting each locally owned facility’s need for account confidentiality.

ETran requires no software for each senior facility to maintain. Deployed in a Software as a Service (SaaS) model, at user login the solution determines if a new version of the application has been published. If it has, the user’s PC is pointed to the latest version of ETran.

ETran’s configurable facility and user-level access permissions and flexible data structure capabilities allow for customized data access and workflows at the individual user, facility and corporate levels.

The final step in the payment automation process deals with the parsing of information that associates the MICR information to resident accounts and distributes that information to each facility’s ETran site. This step allows ETran to automate the association of checks to resident accounts, which after the initial payment from a new resident takes place automatically.

“FTNI did a fantastic job implementing their ETran solution at Benchmark. They operated professionally and eagerly while ensuring all our needs were met, and they went above and beyond to adapt their system to our industry-specific requirements.” ~ Caria Samia, Senior Application Team

Almost immediately upon implementation, Benchmark was able to realize decreased payment processing time frames, as well as increased cash flow as a result of same day deposits facilitated via the ETran RDC Module.

Operating a geographically distributed model, Benchmark Senior Living faced remittance processing challenges typical to the industry. Benchmark operates a network of locally owned but centrally supported senior living facilities throughout New England.

Benchmark set out in search of a Remote Deposit Capture (RDC) solution that would help them consolidate the check acceptance and payment posting process, while respecting each locally owned facility’s need for account confidentiality.

ETran requires no software for each senior facility to maintain. Deployed in a Software as a Service (SaaS) model, at user login the solution determines if a new version of the application has been published. If it has, the user’s PC is pointed to the latest version of ETran.

ETran’s configurable facility and user-level access permissions and flexible data structure capabilities allow for customized data access and workflows at the individual user, facility and corporate levels.

The final step in the payment automation process deals with the parsing of information that associates the MICR information to resident accounts and distributes that information to each facility’s ETran site. This step allows ETran to automate the association of checks to resident accounts, which after the initial payment from a new resident takes place automatically.

“FTNI did a fantastic job implementing their ETran solution at Benchmark. They operated professionally and eagerly while ensuring all our needs were met, and they went above and beyond to adapt their system to our industry-specific requirements.” ~ Caria Samia, Senior Application Team

Almost immediately upon implementation, Benchmark was able to realize decreased payment processing time frames, as well as increased cash flow as a result of same day deposits facilitated via the ETran RDC Module.

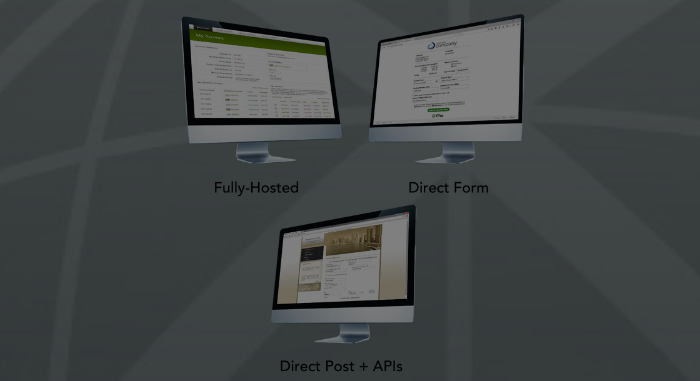

FTNI's ETran Online Payments solutions deliver multiple ways to conveniently and securely accept one-time or recurring online ACH and credit/debit card payments. Offering your customers a...

Learn More.png)

In a rapidly evolving B2B payments landscape, the demand for efficient and secure accounts receivable (A/R) technology continues to grow. Payment acceptance is increasingly shifting towards...

Learn More

Automating and accelerating your accounts receivable (A/R) collections process is essential for maintaining a healthy cash flow within payment processing operations, while also continuing to focus on...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864