Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

In a rapidly evolving B2B payments landscape, the demand for efficient and secure accounts receivable (A/R) technology continues to grow. Payment acceptance is increasingly shifting towards electronic payment methods, and the need for seamless oversight and management of all forms of payment (check, ACH/EFT, credit/debit cards, cash) within A/R operations is paramount.

Many companies are unaware of the extent of the problem caused by siloed systems, or how to address it. As the digital age has generated new payment types and channels at a rapid pace, many problems associated with siloed systems have remained hidden in the back-office. What may appear to be inefficiency and human error, may actually be the systematic failure of an A/R operation. What may appear to be staff burnout, may be the result of employees being overworked trying to manage multiple, disparate systems.

True A/R automation solutions are no longer just a vision, they’re a reality. Right now you can accept any payment type (check, ACH, credit card, debit card, cash, etc.) from any payment channel (mailed-in, called-in, in-person, online, mobile, etc.) on a single platform that can accept, process and post payments in a single pass. There’s no reason to wait. It’s time to tear down the silos!

In a rapidly evolving B2B payments landscape, the demand for efficient and secure accounts receivable (A/R) technology continues to grow. Payment acceptance is increasingly shifting towards electronic payment methods, and the need for seamless oversight and management of all forms of payment (check, ACH/EFT, credit/debit cards, cash) within A/R operations is paramount.

Many companies are unaware of the extent of the problem caused by siloed systems, or how to address it. As the digital age has generated new payment types and channels at a rapid pace, many problems associated with siloed systems have remained hidden in the back-office. What may appear to be inefficiency and human error, may actually be the systematic failure of an A/R operation. What may appear to be staff burnout, may be the result of employees being overworked trying to manage multiple, disparate systems.

True A/R automation solutions are no longer just a vision, they’re a reality. Right now you can accept any payment type (check, ACH, credit card, debit card, cash, etc.) from any payment channel (mailed-in, called-in, in-person, online, mobile, etc.) on a single platform that can accept, process and post payments in a single pass. There’s no reason to wait. It’s time to tear down the silos!

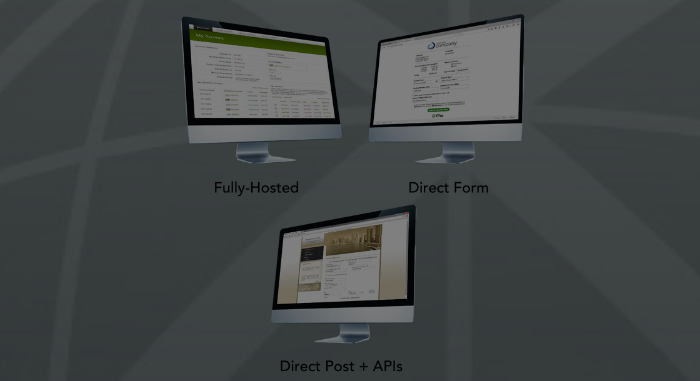

FTNI's ETran Online Payments solutions deliver multiple ways to conveniently and securely accept one-time or recurring online ACH and credit/debit card payments. Offering your customers a...

Learn More

Industry-leading insurance firm leverages Financial Transmission Network’s (FTNI) ETran receivables platform to tackle credit card payments and meet substantial security requirements. Credit Card...

Learn More

Traditional accounts receivable (A/R) processes and collection methods can often be time-consuming, error-prone and lead to delays in payment acceptance, processing and posting. This can disrupt cash...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864