Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

The growth of embedded payment acceptance technology has revolutionized the way businesses accept, process and manage payments across their accounts receivable (A/R) operations. Over the past several years, there has been a significant shift towards seamlessly embedded payment acceptance technology to provide a better user experience for customers while also delivering automated payment processing and cash application for internal A/R teams. Thanks to the rise of electronic payment methods, contactless online payment options, the proliferation of mobile devices, and more, embedded payment solutions now play a key role in the modernization of A/R operations.

By seamlessly integrating embedded payment acceptance technology into your existing webpages, interfaces and applications, your A/R organization is able to manage all payment activity from a central, cloud-based platform, saving valuable time and resources. Integration helps to consolidate payment processing, in turn reducing the manual intervention traditionally needed to accept, process and post incoming payments within your receivable operations.

This free eBook is designed for companies of all sizes who are seeking new ways to improve payment processing and automate cash application operations.

The growth of embedded payment acceptance technology has revolutionized the way businesses accept, process and manage payments across their accounts receivable (A/R) operations. Over the past several years, there has been a significant shift towards seamlessly embedded payment acceptance technology to provide a better user experience for customers while also delivering automated payment processing and cash application for internal A/R teams. Thanks to the rise of electronic payment methods, contactless online payment options, the proliferation of mobile devices, and more, embedded payment solutions now play a key role in the modernization of A/R operations.

By seamlessly integrating embedded payment acceptance technology into your existing webpages, interfaces and applications, your A/R organization is able to manage all payment activity from a central, cloud-based platform, saving valuable time and resources. Integration helps to consolidate payment processing, in turn reducing the manual intervention traditionally needed to accept, process and post incoming payments within your receivable operations.

This free eBook is designed for companies of all sizes who are seeking new ways to improve payment processing and automate cash application operations.

With an SaaS remote deposit capture (RDC) solution from FTNI, this multi-faceted specialty finance firm streamlined payment processing operations and gained an integrated receivables processing...

Learn More

In today’s connected world, customers and consumers have become increasingly accustomed to making payments online. Having a solid online presence for your business customers to easily and securely...

Learn More

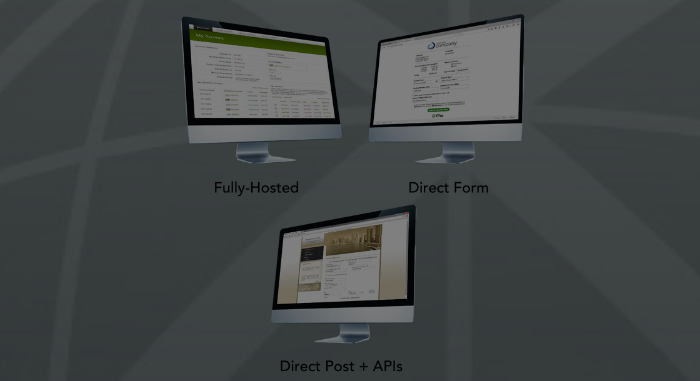

FTNI's ETran Online Payments solutions deliver multiple ways to conveniently and securely accept one-time or recurring online ACH and credit/debit card payments. Offering your customers a...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864