Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Kurt Matis

Originally published on 7/31/2014.

Updated on 2/16/2022.

FTNI’s ETran platform offers a unique and time-saving MICR (magnetic ink character recognition) matching tool that can be used by any business that receives checks from the same payers on a monthly basis (examples include loan processors, insurance agencies, nonprofit agencies, distribution companies, etc.). MICR check matching technology collects account information, MICR line data, and other check details to automatically match incoming check payments to customer accounts. Utilizing MICR matching delivers your accounts receivable (A/R) team with the tools to reduce manual processing time and focus on higher value functions such as exception handling.

So what is MICR and how does FTNI's check matching tool work?MICR verifies the originality of checks and other paper documents. Characters in the MICR line on the bottom of the check are printed with special ink that is sensitive to magnetic fields. The characters on the MICR line usually include the bank code, account number, check number, check amount and a control indicator. MICR characters can be manually read, but the matching technology allows the software to read the MICR line data, scan the information directly into the ETran user interface, and match the check payments to your customer accounts.

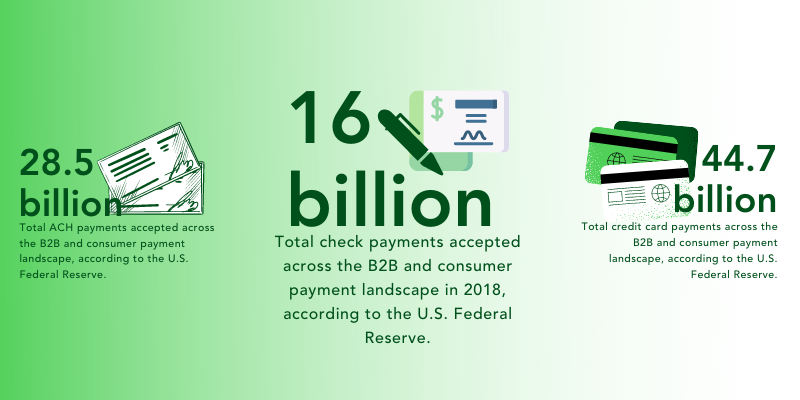

Banks and retailers use MICR to enhance security since the magnetic line is hard to reproduce accurately. Color copied counterfeit checks will not produce a responsive line or will produce an incorrect code when scanned. And since checks remain the most common method for attempted payment fraud, MICR check reading can help reduce most instances of fraudulent checks. According to a report by the Association for Financial Professionals (AFP), 82% of organizations reporting attempted or actual fraud cited checks as the main payment method.

Companies can also use MICR technology to process checks faster. According to Mastercard's Business Payments 2022 report, 50% of B2B payments are still made via check. Regardless of the adoption of electronic payment methods across the B2B landscape, checks are there to stay. As a result, ETran helps companies process checks smarter, faster and more reliably than ever before—all on a single, secure, cloud-based platform. FTNI’s ETran solution offers a MICR check matching tool that automates check processing. On the first pass through ETran, the MICR line is associated with a specific client and related unique account information. A drop down search feature allows the user to search information from the downloaded file. Once the match is made, the customer record is updated.

On any future processes, ETran automates the check processing, so the checks are automatically associated with the correct account each time. Processing payments with MICR matching technology can save up to 70% of a company’s check processing time. Especially powerful for cash application operations, MICR matching allows payment posting to be quick and easy.

The Modernization of Check Acceptance, Proliferation of Electronic Payments, Automated Cash...

Read More

Part 1 of the 3-part True Straight Through Blog Series Here at FTNI, we’ve been in a lot of...

Read More

As we take a look at recent trends, data and what we are seeing with our own customers, a few...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864