Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Colby Ring

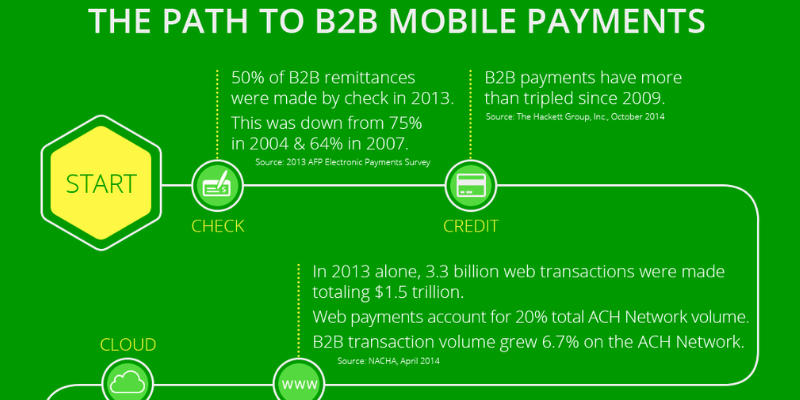

Earlier this year, and for the first time, mobile devices and apps overcame PC access for U.S. Internet usage – accounting for 55% of all traffic. Even though it was the first time, it likely will be the new norm. No longer is the question, “When do I need to prepare for mobile payments?” It is now, “How am I prepared for mobile payments?”

This means that most companies need to be mindful of how mobile payments will impact their business strategies and their customers. Maybe even more importantly, you should be crafting a clear and specific strategy for taking advantage of this new payment paradigm to increase loyalty, add customer convenience, grow lifetime value and streamline their operations.

Yes, “mobile payments” seems to be a never-ending ‘hot topic,’ and many industry experts talk as if it’s a coming tidal wave. However, the reality is that the payment ecosystem is complex – both from a cultural and a technology perspective. That means mobile payments are going to be an incremental revolution, not a sudden, Twitter-style tsunami of adoption that many seem to be anticipating. This is good news for businesses that are still formulating their mobile payments plans.

Some of the complexity that is impacting the rate of mobile payment adoption centers around two topics:

When crafting your plan for mobile payments, it is important to take into consideration these two areas to make sure the provider you select matches the needs and goals you set for your company on both fronts. For example, are you looking for cloud-based or on premise solutions? Cloud adoption and technologies have evolved drastically over the last few years, and multi-million dollar companies that were once on premise only systems are changing over to the security, convenience and benefits the cloud offers.

Cloud vs. on premise is just one small facet of mobile payments that needs to be considered. So hopefully this has you thinking more clearly now: mobile is coming, it’s here to stay, and it’s most likely going to impact your business in a big way… in some shape or form, sooner or later.

To help you with some of the key considerations for your mobile payment strategy, we’ve compiled a set of five tips that we believe are essential to the strategic planning and decisioning process around making the most of the mobile payments paradigm. You can get a free copy of our eBook, The Mobile Payments Train is at the Station: Five Essential Tips for Getting Your Business on Board. And, as you are working through your strategy if you have any questions or want to know more, please don’t hesitate to contact us directly.

Let’s face it, the traditional processes surrounding the processing and management of...

Read More

Whether you’re one of the world’s largest corporations, a small Internet store or somewhere in...

Read More

A successful business actively sells what they believe is the best product or service currently...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864