Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Kurt Matis

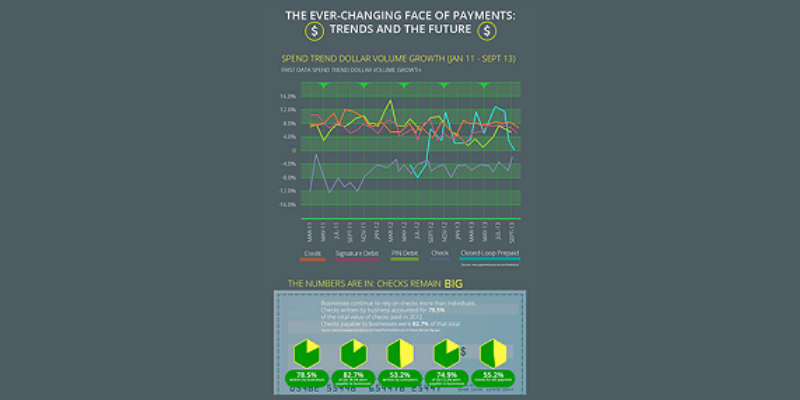

There’s never been a better time to start taking advantage of the new technologies that are emerging within B2B receivables payments processing. Although check use is on the decline in total—in 2013, 50 percent of B2B remittances were made by check, a 75 percent decrease from 2004—checks and remittance documents continue to be a large part of many B2B receivables processes.

There’s never been a better time to start taking advantage of the new technologies that are emerging within B2B receivables payments processing. Although check use is on the decline in total—in 2013, 50 percent of B2B remittances were made by check, a 75 percent decrease from 2004—checks and remittance documents continue to be a large part of many B2B receivables processes.

With automated (self-service) AR, mobile purchasing, and web transactions all on the rise, the B2B payments space is seeing lots of change, and it’s not going to stop any time soon. Having a well thought-out plan to grow and evolve your current receivables processing processes and technology in addition to traditional paper-based remittance processing methods such as check and remittance advice scanning, is crucial.

Customers love the convenience of paying bills online, banking with their mobile devices, and being able to quickly and accurately track their payment records any time and from anywhere. As B2B receivables continue to evolve from from paper-based invoices, checks and remittance coupons (and the associated manual reconciliation that comes with them), to electronic invoices, credit cards, ACH payments, and now, online and mobile payments, many companies have begun piecing together multiple systems and solutions in hopes of keeping up with their customers growing demand for new payment methods and channels.

While your customers may be happy about the flexibility to pay via multiple payment methods and channels, behind the scenes, it may not be the pretty picture of cost savings and efficiency gains that you had originally envisioned. Building and investing in separate payment platforms and solutions can result in data silos that require lots of overhead to maintain, not to mention increased training, oversight and manual reconciliations. The result to you? Platform madness, and ultimately, higher costs.

Platform madness is an easy trap to fall into, and yours wouldn’t be the first company to do so. According to a 2014 study by ACI Worldwide and Wiese Research Associates, more than half of U.S. businesses use siloed electronic bill presentment and payment (EBPP) solutions—costing them $1 billion each year. So how can you stop spending money on manual work and start giving your business a competitive edge? By consolidating your platforms and processing payments in the cloud.

Over the coming weeks, we’ll continue to dive deeper into things to consider as you plot your move from a siloed, messy, and costly receivables infrastructure into an elegantly flexible, affordably deployed and managed, high-security payment processing solution in the cloud.

Here’s a quick glance into the topics you can look forward to:

Well, there you have it, a quick preview into what you can expect to see as we dive into the much talked-about topic of cloud-based B2B receivables processing. Check back regularly as we continue the journey into this new series.

Learn more about the trends and considerations to keep in mind when evaluating mobile payments for your business in our latest infographic.

As we take a look at recent trends, data and what we are seeing with our own customers, a few...

Read More

The Proliferation of Electronic Payment Methods and Channels, Understanding Customer Payment...

Read More

In today’s digital age, payment acceptance technology across the B2B landscape has increasingly...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864