Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Colby Ring

Every year nonprofits generate trillions of dollars in revenue, adding billions to the national economy. These numbers are impressive, but even so, most nonprofits still struggle with increasing the level of donations required to adequately accomplish their charity’s needs. They are challenged with trying to continually raise incoming donations with limited staff and tight budgets.

The good news is that there are some simple changes nonprofits can implement to their giving campaigns that can add up to big results. It’s no surprise that we live in a fast-paced, technology enabled world. The average person is exposed to hundreds of marketing messages each day through a myriad of mediums on a host of different devices. Catching donors attention and getting through to them when and where the message will most resonate can be challenging. However, these same technological advancements can be turned from a challenge into an opportunity for the savvy nonprofit.

Today’s online, connected world means donors expect to do business with you online. That means not only donating online, but managing how (and how often) they interact with your organization, managing their own profile data and their own preferences… activities that are all now considered the new ‘normal.’ The easier and safer you make it for both existing and new donors to submit donations, the more donations you’ll receive.

You can also increase your reach and donor base by leveraging online activities to generate awareness and drive new interest from potential donors that share your mission and passion. Instituting a multi-channel, technology enabled campaign can help you increase the success of your campaign drives through activities such as:

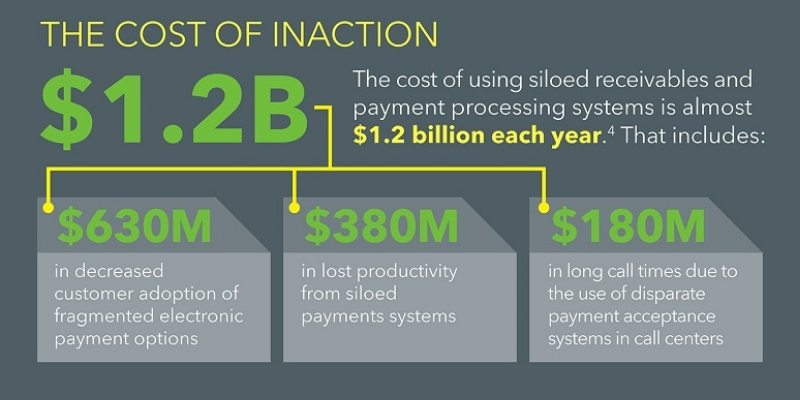

Of all of these activities, having a solid online presence with a mobile-optimized, PCI-compliant website that allows donors to easily (and safely) give online will not only increase your reach and brand awareness, it will also reduce operational costs by allowing donors to set up and manage their giving through your website. That removes manual steps and potential errors from your receivables process, and therefore reduces your costs.

Equally important is selecting a payments processing provider who can support your multi-channel payment approach, giving donors access to the organization how and when they need it, but in a way that simplifies your processes through an integrated payments platform. Whether donors want to pay online, in person, via phone or through their mobile device, FTNI offers advanced technology that will process and post all receivables from a single platform. This simplifies the experience both for your donors and for your back-end operations – helping increase your reach and donation levels while reducing your costs and saving you valuable time.

It’s nearing Christmas Eve, and while many good little boys and girls will have to wait to open...

Read More

Believe it or not, people (and companies) are still using checks to pay their bills. In fact, in...

Read More

Paper is passé. Savvy business people understand that paper pushing is inefficient and expensive....

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864