Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Ashton Steffl

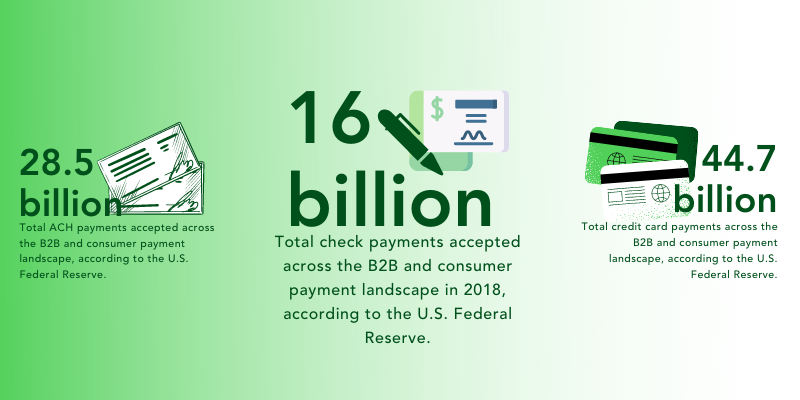

The evolution of payment methods, channels and customer preferences across the B2B payments landscape is continuous and inevitable. Many consumers and businesses are asking for quicker, easier and better ways to pay. And, due to the influx of new technologies and systems into the payments landscape, accounts receivable (A/R) processes are constantly having to shift.

Businesses’ A/R operations are drastically changing, and the legacy systems and siloed dashboards of the past can no longer keep pace. However, many businesses have yet to evolve their operations and processes to efficiently accept, process and post payments across their organization. Internal A/R teams are left with disparate processes, spanning numerous legacy systems, that are inefficient and lack complete oversight across all incoming payments.

And on top of all of this, customers are still asking for easier and more secure ways to pay.

Operational inefficiencies in many organizations’ A/R operations are creating major gaps in their receivables management—not to mention adding considerable cost. Due to the outdated, siloed payment systems of the past, many businesses lack the ability to accept, process, manage and post payments in a single pass—i.e., straight through processing.

Don’t let your receivables management fall behind. Recognizing the most impactful inefficiencies in your receivable processes, and evolving them to streamline payment acceptance and automate cash application, will deliver your business with the tools to achieve accounts receivable automation.

Listed below are five of the top inefficiencies we have seen negatively impact businesses across numerous industries (distribution, insurance, real estate, etc.). By recognizing these pain points in their A/R operations and implementing a truly integrated receivables solution, many businesses have eliminated siloed, legacy systems from their organization entirely. Now is the time to take the next step towards evolving your current A/R processes to benefit not only your organization, but your customers, as well.

1. Paper-Based Receivables Are Slowing Your A/R Processing

Even though many payment processing providers and technology partners boast that paper checks are heading towards extinction, checks are here to stay as a foundational payment method across B2B receivables. Regardless of a general decline in check usage due to electronic methods and channels entering receivable operations, check payments remain a widely used method of payment, with 81% of companies still using paper checks.1 However, the acceptance of checks from your customers may be slowing your A/R processing, but not solely due to the fact that it is paper checks; it’s the way in which your business is processing those checks.

A/R organizations that lack advanced check processing technology spend numerous resources, efforts and excessive amounts of time (and money) on manually accepting, processing and posting checks. Believe it or not, some businesses still even go so far as to physically take the payments to the bank for deposit. In fact, companies that aren’t utilizing modern check processing technologies and solutions can incur costs ranging from ~$4 to ~$20 per check when accounting for FTEs and other costs related to processing checks.2

Without accounts receivable automation software, A/R teams are left to spend valuable time on manually processing and posting paper checks, including keying in associated customer information and payment details into their back-office systems. By implementing an Advanced Remote Deposit Capture (RDC) solution, businesses are able to streamline check and remittance processing, deposit, and cash application from a single solution.

Advanced RDC solutions deliver businesses with the ability to scan checks and remittance documents while seamlessly viewing, associating and storing all account and payment information in a secure, compliant and central location. Your A/R team is able to drastically reduce administrative time spent on processing paper checks (and any associated paper remittance documents) with the added benefit of lowering costs and risk associated with check processing and cash application by automating traditionally tedious, error-prone tasks.

In addition to check processing slowing your receivables, paper-based invoicing can also cause inefficiencies in your A/R operations. Invoice-driven industries rely heavily on customers’ ability to view and pay invoices associated with their account. However, many businesses are limited by paper invoicing. Paper-based invoicing delays receivable processes due to the slow nature in which customers receive and pay their invoice statements, in turn, slowing your management and posting of customer payments.

According to a recent PYMNTS.com report, since the start of the COVID-19 pandemic, 64% of companies have shifted from physical invoicing to electronic.3 By shifting paper-based invoicing to electronic invoicing capabilities, businesses are able to speed their invoice and collection efforts. Electronic Invoice Presentment and Payment (EIPP) solutions provide the ability to streamline your invoice-to-cash operations—all from a single, cloud-based platform. By integrating A/R automation software into your receivable operations, you are able to speed your paper-based receivables and provide your internal team(s), and customers, with a better overall payment experience.

Once you’ve made the switch to electronic invoice presentment, the next step is delivering your customers with easy, secure ways to pay online.

Convenient, contactless online payment solutions have become a necessity for many businesses over the past few years, especially due to the recent hyper disruption and social distancing caused by the ongoing pandemic. Lacking the technology to deliver your customers with an online payment solution to view, pay and manage their invoices/statements can lead to an inconvenient, inefficient and non-secure payment experience while simultaneously delaying your deposits and increasing days sales outstanding.

With the increase in electronic payment methods and channels among businesses and consumers alike, adding contactless online payments is the next step in evolving your A/R operations to fit the needs of your customers, with the added benefit of streamlining your internal receivable processes. Leading payment software providers are able to deliver several online payment options to fit the unique needs of your business, and the payment experience your customers desire.

Whether you’re looking for a fully-hosted payment portal that delivers invoice presentment capabilities, or a secure, embedded payment component that seamlessly integrates with your current website or mobile application, contactless online payment capabilities will provide your business with the tools to automate and accelerate customer payment and cash application. Don’t let the lack of online payment solutions within your receivables slow your processing times, inconvenience your customers, or delay payments any longer. Implement and integrate a contactless online solution to upgrade and modernize your A/R today.

Days sales outstanding (DSO) can be a major hindrance in businesses’ A/R processing. For many businesses who have employees accepting payments in the field (sales representatives, delivery drivers, etc.), DSO times can range from several days to upwards of a week or more. Extended DSO periods delay your cash flow, slow your internal operations, and ultimately, halt your cash application processes. By choosing to add mobile payment acceptance to your existing receivables mix, payments can be accepted and processed on the spot, ultimately resulting in drastically reduced DSO.

Mobile payment acceptance solutions, whether utilized as a fully-hosted stand-alone application or embedded via APIs/SDKs, deliver your field team members with the ability to accept payments (ACH, credit/debit card, check) on the spot and associate the payment to outstanding customer accounts and invoices (if applicable)—all with the added benefit of automatically sending the payment to the home office for review, processing and posting. Mobile solutions allow you to move your payment acceptance from solely the back-office, to the field and front-office.

If you have representatives accepting payments in the field, now’s the time to unlock the power of mobile payment acceptance within your A/R operations.

Each time your A/R team has to manually review a payment, it costs you money. Manual data entry and error-prone receivable processes are the catalysts for slow, time-consuming operations. With siloed cash application (i.e., having to use separate systems for payment processing and posting) plaguing A/R management and resources, many businesses spend valuable time and overhead on processes that can easily be automated on a single platform.

Cash application automation solutions deliver your internal employees with the ability to streamline and automate A/R processes and elevate exception handling from a single SaaS solution. Users are no longer tasked with manually matching payments to customer accounts. Previously required manual intervention for low value activities such as keying in payment details into back-office systems is a thing of the past. Instead, business rules and workflows are able to automate the matching of payments to open A/R (invoices/statements/accounts), or customers are able to select the invoices/statements they are paying via convenient, self-service online payment services.

By allowing your internal resources to focus on higher value functions such as (drastically reduced) exception handling as a result of automated cash application processes, you are able to easily, efficiently and securely accept, process, manage and post all payments in a single pass—i.e., true straight through processing.

Automated cash application solutions are the springboard to true straight through processing of all payments across your A/R organization. Don’t waste any more valuable time on manual, error-prone tasks within your receivables. Automate your cash application today and save valuable time and resources across your entire organization.

Historically, A/R organizations have had to utilize multiple, disparate systems and legacy dashboards (AKA, ‘Silos’) to accept and manage different payment methods and channels—and unfortunately, far too many companies still are. In fact, it has been estimated that the cost of using siloed receivables and payment processing systems costs U.S. companies over $1B each year.

So, what exactly are siloed payment processing systems? Timely question.

If your organization has to manage multiple systems to process different incoming payment methods (checks, ACH/EFT, credit/debit card, cash) or channels (online, AutoPay, lockbox, mobile) and then manually associate the payments to customer accounts and key in the details for back-office posting—then you have silos.

Many organizations lack a single platform that streamlines and automates the entire process from payment acceptance to depositing, cash application, and every step in between. There’s no shortage of technology providers today that have smart dashboards and systems capable of taking feeds of your A/R and payment data, matching it and helping to transmit that information to your back-office systems. Unfortunately, behind the vast majority of those pretty dashboards lie more silos.

Truly integrated accounts receivable automation software provides payment acceptance, processing, management, and cash application from one convenient, SaaS, user interface. By utilizing a single, cloud-based solution, internal teams are able to reduce, or completely eliminate, time-consuming, error-prone tasks, and remove tedious work and potential issues from having to key in data from various different systems. By implementing integrated receivables technology into your current A/R operations, you are able to allow for efficiency within your processes and save valuable time and money across your organization.

______________________________

As the B2B payments landscape continues to evolve and customers’ payment preferences continue to change, businesses have to make a choice between evolving with the increasing demands of updating technology and the vast benefits that come along with it, or continuing to fall further behind with the siloed systems of the past. Don’t let your business fall behind and allow inefficiencies in your A/R operations to inhibit your receivables management and slow your cash application operations any longer.

Many organizations may think “I don’t have the time or budget to overhaul my accounting operations.” However, with a true SaaS-based platform, converting and updating your receivable processes can be quicker and easier than you think—all at a cost that will have a meaningful and impactful return on your investment. In short, it’s much quicker and less expensive than many businesses realize.

Now is the time to recognize the ineffectual processes that are standing between you and accounts receivable automation. There is truly no better time than right now to update and accelerate your receivables. With these five actionable insights provided, you are able to take the next step in automating your receivables and cash application operations. It has never been easier to turn around the inefficiencies within your organization; discover the solutions and software that can accelerate your business needs today, tomorrow and years into the future.

1 PYMNTS “March 2020 PYMNTS Playbook”

2 Bank of America 2019 Study

3 PYMNTS "B2B Payments Innovation Readiness Report"

The way businesses manage payment acceptance and processing within accounts receivable (A/R)...

Read More

Over the last decade, “Integrated Receivables” has generated quite a bit of buzz, not only in the...

Read More

The Modernization of Check Acceptance, Proliferation of Electronic Payments, Automated Cash...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864