Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Zac Robinson

2015 B2B ecommerce sales in the US are expected to exceed $780 billion1—twice as much as B2C ecommerce sales—and that number is only going to continue to rise. That’s a big opportunity. Are you ready for it?

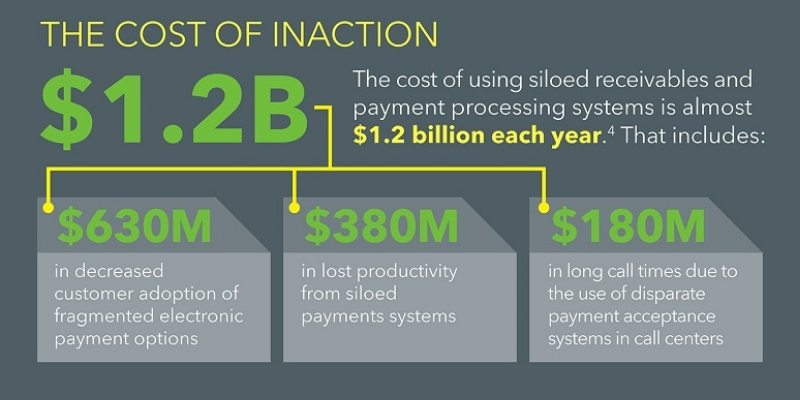

Chances are, you’re not. About 70 percent of U.S. organizations are struggling to convert to electronic payments; 70 percent also do not have a standard format for remittance information2. In short, companies don’t have a complete solution—they’re using multiple legacy platforms to handle different payment types (like check, ACH, CC, cash) and different payment channels (mailed-in, called-in, in-person, online, mobile).All that siloization leads to increased operational inefficiencies and expense: $1.2 billion each year in the U.S. alone, in fact3.

In a rush to meet the electronic payment needs of customers, it can be easy for companies to overlook a large part of a comprehensive remittance strategy — the management and processing of checks. Efficiently and cost effectively managing check payments is the foundation for building an effective integrated receivables solution. In fact, 93 percent of checks deposited as images in 2014 came from business customers4.

Clearly, checks are still widely used. They have also been expensive and historically manual in processing and posting. Businesses must get checks right in order to successfully integrate other payment types and channels on a single, consolidated platform. Checks will be with us for the foreseeable future, and may always be around despite what some critics claim. Streamlining check acceptance, processing and posting is a key component for true integrated receivables solutions.

True integrated receivables solutions are no longer just a vision, they’re a reality. Right now you can accept any payment type from any payment channel on a single platform that can accept, process and post payments in a single pass (what we call straight through processing). Information is automatically posted into a company’s back-office system to eliminate redundancy and error while also reducing labor costs.

There’s no reason to wait. It’s time to tear down the silos!

The problem is that a lot of banks and solution providers claim to sell integrated receivables (IR) solutions—but in actuality, provide fairly basic dashboard feeds of transaction activity . Unlike a dashboard that just brings together transaction feeds from disparate systems, truly integrated solutions support the initiation, acceptance, processing and posting of all transactions from a single, unified platform.

With that in mind, we suggest that when you’re researching IR solutions, make sure the platform you choose has these 8 attributes.

True Integrated Receivables Solutions Checklist:

1. Be easy to deploy and support — Software as a Service (SaaS) solutions maximize cost savings and flexibility.

SaaS solutions are also known as cloud solutions. Your vendor provides the hardware for you—which means you don’t have to invest in any servers or pay for an IT team to maintain them—and provides you access to your solution via the web. Using the cloud means having access to the latest security and compliance protocols like PCI compliance, not to mention the ability to make rapid changes to your infrastructure whenever you need it.

2. Accept any payment type (Check, ACH, CC, cash).

Truly integrated IR solutions will integrate all payment types and all payment channels on a single platform. It’s not just a dashboard feed of your transactions—that’s not integration, that’s just consolidating information from different data sources. An IR solution that’s worth your time will integrate everything from initiation, acceptance, processing, and posting of the transaction all on the same platform. That reduces labor costs and human error.

3. Support any payment channel (mailed-in, in-person, by phone, web, and mobile).

A true integrated receivables solution offers modular abilities to meet your specific needs. If you only want to manage check scanning to begin with, then the platform should be able to offer that capability without being tied down by other payment channel modules. You get to choose which methods and channels you want to pair with your systems. Other payment channels can then be added as you need them, all available on the same platform with the same common operating engine — integrated.

4. Enable straight through processing (accept, process and post from a single platform).

Look for a platform that offers you straight through processing, so that you can accept, process, and post payments in a single pass. That ensures consistency in your process rules and workflows, and gives you all the information you need in one repository, regardless of what payment method or channel was used. Once you’re on a single system, it won’t matter whether the payment was in cash, check, ACH, credit card, or if it came from your lockbox, online payment portal or even via your mobile app. You’ll have a unified interface and repository of all those receivables items. For more information, see our blog posts about straight through processing.)

5. Deliver multiple layers of proactive security and compliance.

One of the biggest, most important benefits of cloud-based, true integrated receivables is robust security and compliance. While running in the cloud, businesses benefit from full-time security and compliance experts whose entire focus is protecting your and your customers’ data. You will no longer need the overhead of dedicated security staff maintaining your various, disparate systems’ security requirements. The compliance and security components are all up-to-date and actively managed by both the system provider and the hosting provider. By choosing the right integrated receivables solution, you can rest assured the appropriate levels of compliance, especially PCI, are in place.

6. Streamline exception handling via automated AR processes and workflows.

When you automate routine accounts receivables processes, not only do you increase AR efficiencies, but you’ll also get to the exceptions more quickly. You’ll increase efficiencies by freeing up your staff to tackle complex problems. A good IR solution will also enable you to configure processes and workflows across multiple locations or lines of business, even when different locations must maintain their own unique processes.

7. Be agnostic in nature — compatible with existing banking, merchant processor, back-office and check-scanner relationships.

Being agnostic maximizes flexibility and scalability, ensuring your chosen integrated receivables solution is compatible with existing banking, merchant processor, back-office and even check scanner relationships. For corporations this is vital because business needs and relationships change, sometimes quite often. An agnostic system means you don’t have to change platforms or rebuild existing processes as your business evolves both internally and externally. For banks, once again, being agnostic increases “stickiness”…if corporate customers have to (or choose to) add/change banking relationships, this can help retain revenue that they would’ve otherwise lost if they did not have strong value-added solutions such as an integrated receivables platform.

8. Grow and adapt as your business changes (i.e., configurability vs. customization).

We hear a lot about customization in our line of work, and it’s not all it’s cracked up to be. You want a platform that’s configurable, not customizable. Customizable implies that you’ll have to pay for a lot of extra work to make the solution work with your environment, whereas a configurable solution already has all the bells and whistles you need built right in. You just have to turn them on. Your IR solution should easily accommodate your processes and workflows, even streamlining them for you. It should also give you a broad and deep ability to do consolidated reporting and detailed reconciliation.

Final Thoughts

When you’re in the market for an IR solution, take your time and do your research. Make sure that the platform accepts any payment type from any payment channel, enables straight through processing, and offers robust automation capabilities. It should be modular and agnostic in nature and have built-in configurability so the platform can be quickly and easily personalized to your needs, and then evolve with you as your business grows.

Originally Published January 8, 2016.

Sources

1 Forrester Research

2 2013 AFP Electronics Payments Survey

3 ACI Worldwide & Wiese Research Associates study, “Identify & Eliminate Hidden Expenses,” 2014

4 Remotedepositcapture.com 2014 Special Report: “Remote Deposit Capture: A Decade in the Making”

Many enterprises now offer recurring ACH as an option when agreeing to payment terms – especially...

Read More

US companies are wasting $1 billion each year because their receivables and payment processing...

Read More

Believe it or not, people (and companies) are still using checks to pay their bills. In fact, in...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864